There is nothing certain in life, according to the old adage, except death and taxes. And, maybe, grocery shopping.

Most of us have to buy food at some point. Whether it’s a pop-in trip to pick up a few items for dinner or a heavy-duty stock up that’ll hold the household for a few weeks, the act of grocery shopping hasn’t changed all that much from picking items from off the shelf to checking out.

The fact is that all might be changing, quickly. And you’ve probably already answered the question of how or why — e-commerce.

When Amazon paid $13.7 billion to buy Whole Foods a little over a year ago, it was a wake-up call for the industry. That kind of investment to build a cross-platform, omni-channel selling network means the future of grocery shopping is online. And brands sat up and paid attention.

But what does this mean for the future of food and beverage packaging? Well, a lot.

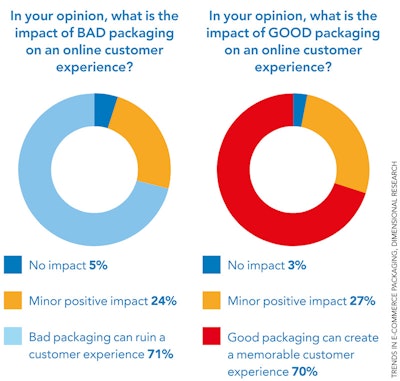

“Packaging is key to e-commerce, with an overwhelming majority of consumers saying it can have a positive impact — or ruin an otherwise positive purchase experience,” said Alexandre Carvalho, director global marketing services at Tetra Pak.

Tetra Pak recently completed its 11th annual Tetra Pak Index, a report based on consumer research conducted in five countries. This year, the report focused on e-commerce in the food and beverage industry and what opportunities this mode of retailing might bring.

“Fast-growing online grocery will be a major disruption of the industry, with double-digit growth in online grocery expected in the next four years,” said Carvalho. “Offline and online are merging to create both a better customer experience and better efficiency for the entire supply chain.”

So what’s driving the growth of online grocery? What else, but convenience. Consumers want a better way to shop, one that’s faster and easier than ever before.

“Food and beverage producers can tap into this trend by providing convenient packaging — i.e. easy-to-open, robust and lightweight packages, that can be safely delivered without the need for excess secondary packaging,” added Carvalho. “Space efficient and ‘frustration-free’ packaging is expected to become a basic requirement from consumers by 2025 in direct response to the consumer demand for convenience.”

CPGs sold via e-commerce must incorporate easy-to-store, easy-to-open packaging design because failure to do so could affect the consumer’s perception of the product.

For example, in research from WestRock’s Packaging Matters 2017 report, consumers were interviewed about their level of satisfaction in the packaging of products from several categories. Among the worst of the performers was the packaging of online foodservice delivery and meal kit subscription services products.

According to the report, 31 percent of those surveyed said they were either moderately, slightly or not at all satisfied with the packaging in this category. Moreover, eight out of 10 respondents who had experience with online foodservice delivery and meal kit subscription services said they would cancel the service if the packaging was bad.

It’s an interesting finding to look at especially a year later since these types of companies were the darling of the food and beverage industry back then. Now, however, there are certain indications that the meal-kit market might be in trouble; one notable recent development was the shuttering of Chef’d, a three-year-old, Los Angeles-based meal kit provider.

One example of logistically efficient packaging is Tetra Pak’s Tetra Brik Aseptic 1000 Edge Bio-based LightCap30. Source: Tetra Pak.

One example of logistically efficient packaging is Tetra Pak’s Tetra Brik Aseptic 1000 Edge Bio-based LightCap30. Source: Tetra Pak.Environmentally Friendly Packaging

Smaller package sizes is another trend identified by this year’s Tetra Pak Index. This is because, according to Carvalho, household sizes are reducing and increasingly more people are living in urban homes, which are smaller and have less storage available. Thus, more frequent, but smaller volume shopping trips are becoming more common.

“This makes consumers more appreciative of space-efficient packaging,” said Carvalho.

Because space-efficient packaging for consumers is also logistically efficient in the supply chain, with the potential to reduce an operation’s shipping costs and carbon footprint, it is also more environmentally friendly, added Carvalho. Thus, this trend dovetails with another consumer packaging concern: sustainability.

Starbucks made news recently due to announcing its coffee stores would discontinue providing plastic straws in the future. This sparked huge interest in the foodservice industry in paper straws. So much so, the only U.S. paper straw manufacturer in existence a few months ago was acquired weeks after this announcement because the company couldn’t meet the spiked demand.

This move shows brands are getting serious about their products’ environmental impact and how consumers perceive their commitment to sustainability. Demand for environmentally-friendly packaging is on the rise globally, said Carvalho, so food and beverage producers should avoid unnecessary secondary packaging and ensure recyclability wherever possible.

“Plastic packaging is under severe pressure with high profile initiatives under way to reduce its impact on the environment, especially the oceans. As public concern increases, food and beverage producers need to respond accordingly,” he said.

Carton packaging could be one answer to meet the demands posed by consumers wanting convenient packaging that is easy to order online and is environmentally friendly.

“Lightweight, logistically efficient carton packaging has a valuable role to play in online grocery, both in reducing shipping costs and carbon footprint,” he said. “It’s increasingly being used as a differentiator by brands and e-retailers.”

This infographic from the Tetra Pak Index 2018 shows the effect of packaging on consumers’ experience with products. Source: Tetra Pak.

This infographic from the Tetra Pak Index 2018 shows the effect of packaging on consumers’ experience with products. Source: Tetra Pak.Aseptic Processing & Packaging

To prepare for this new atmosphere of CPG retailing, aseptic processing might offer one solution for food and beverage manufacturers. Jason Osicka, senior process engineer for CRB, a plant architecture and engineering firm, said aseptic processing offers several benefits because it consistently produces high quality, shelf-stable products that don’t require refrigeration.

“Packaging size and shape can be easily changed and large volume packages— (for) full truckloads or shiploads — are possible,” said Osicka.

And because aseptic processing doesn’t necessarily require stabilizers and preservatives, it is capable of producing clean label products. So aseptic seems like it ticks all the boxes of modern food and beverage manufacturing’s needs.

However, Pablo Coronel, PhD and director of food processing for CRB, said in aseptic processing, food safety is of utmost importance because if something does happen to go wrong, the shelf-stable product has the potential to kill a person if consumed.

“Every aseptic process is designed and validated to inactivate all microorganisms of public health concern and those that cause spoilage under normal conditions, and to maintain the product commercially sterile for many years,” said Coronel.

He said it is important to monitor and record all data of the critical control points (CCPs), which are:

- Process line sterilization

- Packaging equipment sterilization

- Maintenance of sterilization

- Product hold time and temperature

- Sterilization of package and closure.

Coronel said QA departments should be sure to document and properly store secure electronic and/or hard copies of production records going back three years. Staff should closely review batch/lot records and closure integrity.

But for those plants that incorporate aseptic processing and packaging, shelf-stable product distribution can be extended to new markets, possibly even to locations outside the US, while keeping your production centralized. And it’s considered to be environmentally friendly.

“(You can) significantly reduce the supply chain carbon footprint by using non-refrigerated distribution,” said Osicka.

Remember, Osicka added, that project stakeholders need to consider the R&D effort for new packaging and closure design, which could include new secondary and tertiary packaging requirements.

Emphasis On The Experience

For last few years, there has been a lot of talk about the possibilities of smart packaging opening up marketing opportunities with consumers. One example is incorporating promotional gamification activities on packaging. However, a successful push into that has yet to be seen.

“The key to smart packaging technology creating opportunities for consumer interaction is digital printing, which makes it possible to print a unique digital code on each and every package,” said Carvalho. “This can be scanned by both specialist devices and ordinary smartphones alike, allowing all kinds of innovative possibilities.”

One possibility could be brands linking their entire supply chain from end to end and sharing that information with their consumers. This would be a significant step in satisfying consumers’ growing demand for brands to be more transparent about products’ production processes and ingredients.

Additionally, packaging can be used by brands to engage their customers, such as by incorporating a lottery ticket with a unique identifier for an online competition or including a loyalty token to create a one-to-one channel with individuals.

“The information flow can be two-way, allowing producers to capture specific, valuable information about their consumers as part of the digital code interaction,” said Carvalho.

And don’t forget about products and packaging being more customized and personalized to individuals.

“With an ever-growing expectation of ‘personalization’ and ‘uniqueness’, food and beverage manufacturers will be expected to provide consumers with something different and memorable to help their brands rise above the noise and create a shareable experience for the shopper,” he said.

However, with more customization comes more variation, which means food and beverage operations must become more flexible to change both product formulations as well as the packaging. Carvalho said Tetra Pak is working in this area to make their equipment more flexible in the future and enable quicker changeovers on production lines.

Debra Schug is a contributing writer for Food Manufacturing.