CHICAGO, June 27, 2018 (PRNewswire) — The Protein Industry is seeing extra "bite" as the concept of "craft meats" takes hold, according to the Consumer & Retail Insider, an industry report released by Brown Gibbons Lang & Company.

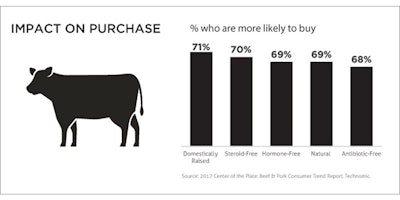

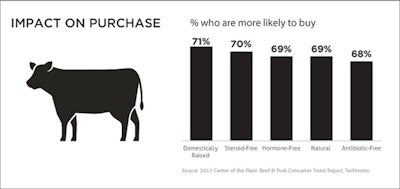

Macro trends of population growth and rising disposable income have contributed to an increase in meat consumption. Rising demand, coupled with healthy living trends and a craving for all things natural and organic, are refining palates for artisan meats. As quality, authenticity, and transparency gain increasing appeal among today's discriminating consumers, changing food preferences are taking niche protein markets mainstream.

The craft meats concept has attracted investor interest in line with favorable demand trends, illustrated by recent transaction activity in the space:

- Natural and grassfed beef producers have been acquisition targets, with Blue Apron (BN Ranch), Marubeni Corporation (Creekstone Farms), Verde Farms (Estancia Beef), and High Street Capital (Open Range Beef) among the investors to complete recent deals. The Grassfed Beef market has sustained double-digit growth with rising demand projected to propel market penetration.

- Hormel Foods set its sights on charcuterie-style meats with the $850 million acquisition of Columbus Manufacturing, paying a premium valuation at approximately 13.0-15.0x projected 2018 EBITDA, including synergies. The deal marks the largest in Hormel's history. Artisan cured meats have been cited as a thriving niche market and appealing to today's millennial "foodie" culture.

- Direct-to-consumer platforms in craft meats are attracting investor capital. This May, Crowd Cow raised $8 million in a Series A funding led by Fuel Capital and Madrona Venture Group. The rapidly growing e-commerce startup pledges quality and transparency, delivering premium grassfed beef from farm to fork through an innovative crowdsourcing model.

Access the full Investors Feast on Craft Meats report from our Food and Beverage industry experts.

About Brown Gibbons Lang & Company

Brown Gibbons Lang & Company is a leading independent investment bank serving the middle market. BGL specializes in mergers and acquisitions advisory services, debt and equity placements, financial restructuring advice, and valuations and fairness opinions, with global industry teams in Business Services, Consumer & Retail, Environmental & Industrial Services, Healthcare & Life Sciences, Diversified Industrials, Metals & Metals Processing, and Real Estate. BGL has offices in Chicago, Cleveland, Philadelphia, San Antonio, and San Diego in addition to Global M&A partner offices in more than 50 countries across 5 continents. BGL is able to deliver to our clients unparalleled access to strategic relationships, investors, and opportunities globally. For more information, please visit www.bglco.com.