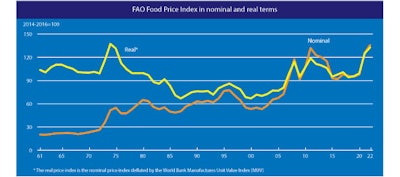

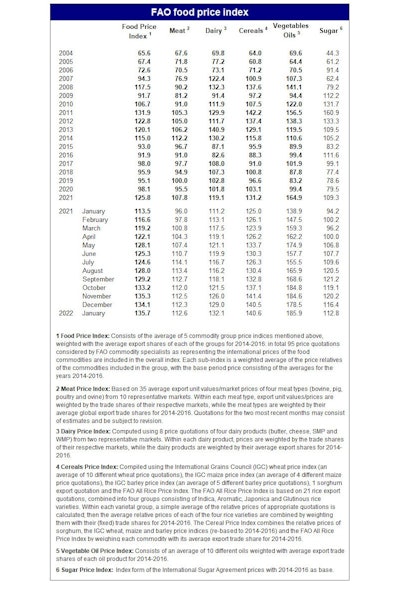

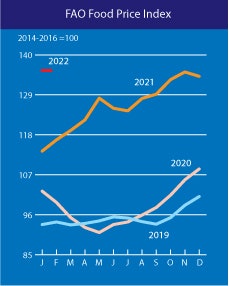

The FAO Food Price Index (FFPI) is a measure of the monthly change in international prices of a basket of food commodities. It consists of the average of five commodity group price indices weighted by the average export shares of each of the groups over 2014-2016

JANUARY

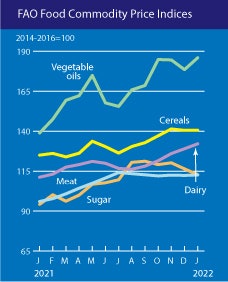

The FAO Cereal Price Index averaged 140.6 points in January, up marginally (0.1 percent) from December and 15.6 points (12.5 percent) above its level one year ago. World wheat prices eased in January, down 3.1 percent, with increased seasonal supplies from large harvests in Australia and Argentina. However, support from continued strong demand amidst tight global availability of higher-quality wheat along with uncertainty over exportable supplies, prevented prices from declining further. By contrast, maize export prices were firmer in January, gaining 3.8 percent since December, mostly on concerns of persistent drought conditions in the southern hemisphere, namely Argentina and Brazil; spillover effects from the wheat market added upward pressure on maize prices. Among other coarse grains, international sorghum prices also rose in January, in line with maize price trends, while barley quotations were slightly lower. The completion of main-crop harvests in major suppliers and purchases by Asian buyers also raised international rice prices in January by 3.1 percent.

The FAO Vegetable Oil Price Index averaged 185.9 points in January, up 7.4 points (4.2 percent) month-on-month, marking an all-time high. The rise reflected higher quotations for palm, soy, rapeseed and sunflowerseed oil. After a short-lived drop, international palm oil prices rebounded in January, largely underpinned by concerns over a possible reduction in export availabilities from Indonesia, the world's top palm oil exporter, as well as subdued output in key producing countries. World soyoil prices also recovered, supported by robust import purchases, particularly from India. In the meantime, rapeseed and sunflowerseed oil prices were buoyed by, respectively, lingering supply tightness and surging global import demand. Rising crude oil prices also lent support to international vegetable oil values.

The FAO Meat Price Index* averaged 112.6 points in January, up slightly from December 2021, and lifting the index value 16.6 points (17.3 percent) above its corresponding month a year ago. In January, bovine prices reached a new peak, underpinned by strong global import demand exceeding export supplies, mainly from Brazil and Oceania, reflecting lower cattle supplies for processing. Meanwhile, pig meat quotations rose slightly, as labor shortages and high input costs dampened global supply, countering the downward pressure from China's slowdown in imports. By contrast, ovine and poultry meat prices softened further, as global exportable supplies outstripped import demand, despite constrained supplies stemming from COVID-19-related production and transportation delays, and avian flu outbreaks in some large poultry meat producing countries.

The FAO Sugar Price Index averaged 112.8 points in January, down 3.7 points (3.1 percent) from December, marking the second consecutive monthly decline and the lowest level in the past six months. The January decline in international sugar price quotations was mostly related to favorable production prospects and good harvest progress in major exporters, India and Thailand, and improved rains in key growing areas of Brazil. In addition, lower ethanol prices in Brazil exerted further downward pressure on world sugar prices in January. However, the strengthening of the Brazilian Real against the US Dollar, which tends to restrain shipments from Brazil, the world's largest sugar exporter, prevented more substantial sugar price declines.